Key Benefits

Maximize your NCUA insurance coverage eligibility while earning competitive returns on your deposits.

Extended Insurance

Your funds are protected, up to $15 million, through our NCUA-insured partner network, all managed through one simple account.

Auto-Sweep

The system distributes funds across partner institutions.

Competitive Rates

Earn interest on your full balance while protecting your deposits.

How the Account Works

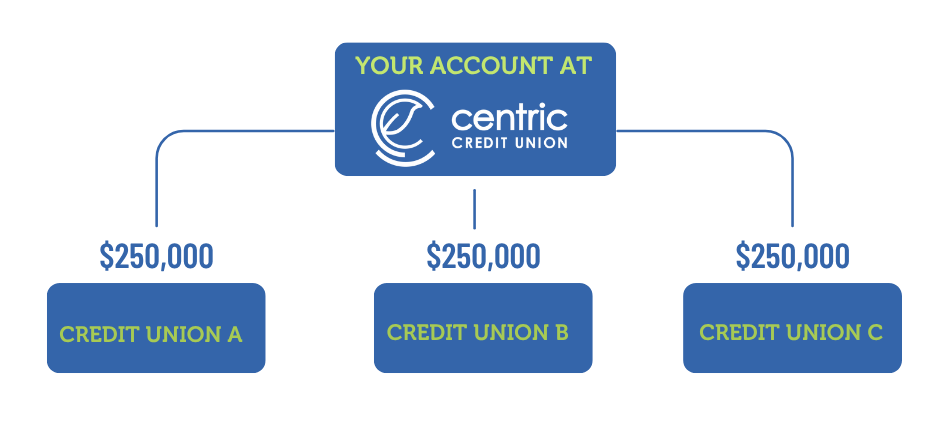

With Centric’s Extended Insurance Account, your deposits are automatically divided into portions of less than $250,000 and placed across a network of partner credit unions. This keeps every portion within standard NCUA insurance limits while extending protection up to $15 million* in total coverage.

The best part? You’ll still manage your money through a single Centric account, while the system takes care of the behind-the-scenes distribution—so your funds stay secure and fully accessible without the extra hassle.

FAQs

What is an Extended Insurance Account?

An Extended Insurance Account provides millions of extended NCUA insurance on your deposits by distributing your balances in amounts under the $250,000 threshold to partner credit unions in the ModernFi network. By placing funds under the limit, your entire balance can be insured by the NCUA. These accounts combine to provide you with extended insurance coverage.

What is ModernFI?

ModernFi is a network of credit unions that Centric has joined to help better protect your balances by distributing funds across partner credit unions to offer extended NCUA share insurance.

How Does the Extended Insurance Account Work?

Let’s say you want to safeguard $1 million while still earning interest. With Centric’s Extended Insurance Account, you can deposit the full amount into one Centric account. Behind the scenes, your funds are distributed to partner credit unions in amounts under the $250,000 NCUA insurance threshold.

For example, the first $250,000 may remain at Centric, while the next portions are placed with other partner credit unions in the network. Because each portion stays within the NCUA insurance limit, your full $1 million is protected.

The benefit? You don’t have to open or manage multiple accounts. All your deposits and transactions appear in one easy-to-read Centric statement. Plus, our Extended Insurance Account offers a competitive interest rate, making it a smart choice for businesses and individuals with significant cash reserves.

Who Maintains My Extended Insurance Account?

You control the account just like a regular transaction account. The portal allows you to view your balance and request withdrawals from your extended insurance account. If you would like to deposit funds, you can do so directly with the Centric team! Centric manages and oversees your allocation, ensuring funds are distributed to demand deposit accounts within the network.

How Secure is the Extended Insurance Account?

Extended Insurance Accounts offer a high degree of security for your deposits, utilizing NCUA insurance to safeguard funds up to $250,000 per member at each participating credit union. This protection extends even in the event of a participating credit union’s failure, ensuring the continued safety of your deposits. Since the inception of the National Credit Union Share Insurance Fund in 1970, no member has lost NCUA-insured funds due to a credit union’s failure. All accounts at NCUA-insured credit unions are covered on a dollar-for-dollar basis, encompassing principal plus any interest accrued.

In the unlikely event a credit union fails, the NCUA assumes the responsibility of closing the credit union, receives its assets, and settles all deposit claims. Centric works with ModernFi to file all required materials with the NCUA to coordinate the receipt of your funds from the failed institution. Payment starts within a few business days after the credit union closure. For more information on NCUA insurance, please visit here.

How Do I Open an Extended Insurance Account?

After account opening, you will gain access to the “Member Portal” to view details on your Extended Insurance Account. You can view statements and your allocations throughout the network at any time, so you always know your money is safe with credit unions you know and trust.

Become a Member >

Get Started!

* Insurance provided through Centric Credit Union and partnering credit unions (subject to certain conditions)

Funds participating in the Centric Extended Insurance Account are deposited into accounts at participating credit unions, which are insured by the National Credit Union Association (NCUA) for up to $250,000 for each category of legal ownership, including any other balances you may hold directly or through other intermediaries, including broker-dealers. The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured. Please read the Program Terms and Conditions carefully before depositing money into the program, and for other important customer disclosures and information. To assure your NCUA coverage, please regularly review credit unions in which your funds have been deposited, and notify Centric immediately if you do not want to allocate funds to a particular credit union or credit unions.The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured.

Please read the Program Terms and Conditions carefully before depositing money into the program and for other important customer disclosures and information. To assure your NCUA coverage, please regularly review the credit unions in which your funds have been deposited, and notify Centric Credit Union immediately if you do not want to allocate funds to a particular credit union or credit unions.