Suspicious Transaction

Notice a suspicious transaction? Take action fast.

Contact Centric immediately at 318-340-9656 to report unauthorized activity. Our team will guide you through the next steps based on your situation.

You can temporarily freeze your debit card using the Card Management area in the CentricCU app. It’s a quick way to help stop fraud before it happens.

To stay even more informed, turn on debit card alerts in the CentricCU app to get real-time notifications about out-of-state purchases, card status changes, and more. Peace of mind is just a tap away.

Lost or Stolen Card

If you think your card has been lost/stolen or compromised, call/text us right away at 318-340-9656, 24/7. You may also report your card lost/stolen and request a reorder inside the CentricCU app in the Card Management area.

Email Compromise

If your email login or password has been knowingly or unknowingly shared, or if any suspicious emails have been sent from your account—especially those authorizing transactions or requesting account changes—contact Centric right away at 318-340-9656. We’re here to help protect your information and secure your accounts.

Identity Theft

If you receive credit cards you didn’t apply for, bills from unfamiliar companies, or loan rejection letters for accounts you didn’t request, you may be a victim of identity theft.

Here’s what to do:

1. Report it right away

-

Call/text Centric immediately at 318-340-9656 to report any suspicious activity.

-

Go to IdentityTheft.gov to file a report with the Federal Trade Commission (FTC) and create a personalized recovery plan.

-

File a report with your local police department, and be sure to keep a copy or note the report number.

-

Submit a complaint to the Internet Crime Complaint Center (IC3), a division of the FBI focused on cybercrime.

2. Notify the credit bureaus

Place a fraud alert or credit freeze by contacting the three major credit bureaus:

-

Equifax: 800-685-1111

-

Experian: 888-397-3742

-

TransUnion: 800-888-4213

3. Update your information

Notify all relevant parties that your identity has been compromised:

-

Financial institutions (including credit card and loan companies)

-

Insurance providers, utility companies, and government agencies

-

DMV and Social Security Administration

4. Secure your accounts

-

Change usernames, passwords, and security questions on all online accounts—especially online banking, email, and social media.

-

Enable multi-factor authentication (MFA) wherever possible for extra protection.

5. Monitor your credit and financial activity

-

Regularly check your credit reports and bank accounts in the CentricCU app.

-

Consider enrolling in a credit monitoring service to receive alerts on suspicious activity.

-

Contact the IRS at 800-829-1040 to request an Identity Protection PIN to prevent tax-related fraud.

⚠️ Remember: Credit monitoring can alert you to fraud—but it won’t prevent it. If you get an alert, act quickly to protect your accounts and limit further damage.

Suspicious Call or Text

Never share personal information like your online banking username, password, or multi-factor authentication code with anyone.

Centric will never ask for sensitive information over the phone, through text, or by email. We will also never send you a link asking you to verify your info or review suspicious transactions.

Even if a call or message looks familiar—don’t trust it at face value.

-

Don’t press the call-back button.

-

Instead, manually dial the number you know and trust – 318-340-9656 for Centric.

If you did share personal information, contact Centric immediately at 318-340-9656. We’ll help secure your accounts and guide you on what to do next.

Suspicious Email

Never click on links or open attachments from unfamiliar emails. Fraudsters often mimic trusted names or companies using email addresses that look almost right.

Even if the email is from someone you know, be cautious—if it seems out of character, includes typos, or feels off in any way, don’t reply. Contact the sender through another method to make sure their account hasn’t been compromised.

Never share personal or sensitive information over email. Emails are not secure, and Centric will never ask for your online banking username, password, or multi-factor authentication code via email.

When in doubt, exit the email and contact directly at 318-340-9656. We’re here to help keep your information safe.

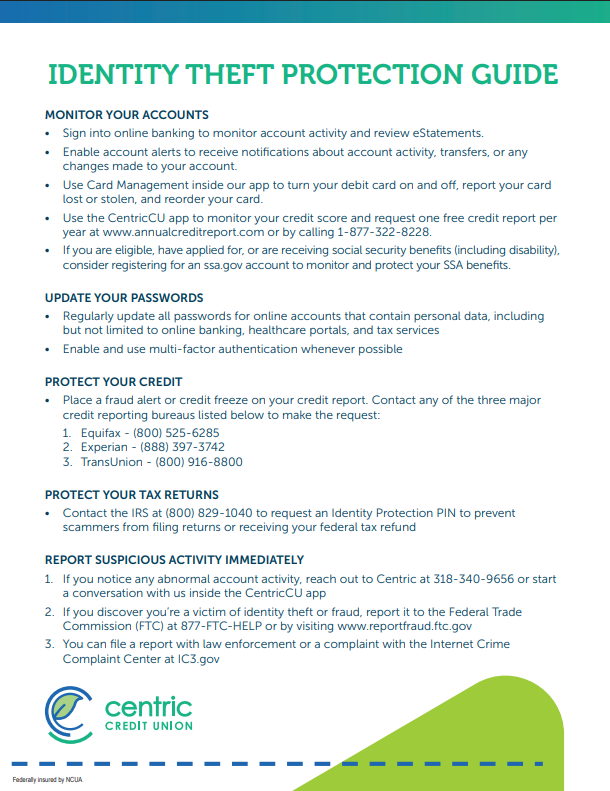

Identity Theft Protection Checklist

Download Centric’s Identity Theft Protection Checklist here to learn more about protecting your account and personal information.